General Knowledge for SSC Exams (Insurance And Stock Exchanges)

General Knowledge for SSC Exams (Insurance And Stock Exchanges)

Insurance :-

- Insurance has been an important part of the Indian financial system. Until recently, insurance services were provided by the public sector, i.e., life insurance by the Life Insurance Corporation of India and general insurance by the General Insurance Corporation and its four subsidiaries.

- The insurance industry was opened up to the private sector in August 2000. After the opening up, 12 new companies have entered the life segment and 9 companies in the non-life segment.

1. Life Insurance Corporation (Lic)

- Established : Sept 1, 1956.

- Head office : Mumbai.

- Zonal offices : 7 (Mumbai, Kolkata, Delhi, Chennai, Kanpur, Hyderabad and Bhopal)

2. General Insurance Corporation (Gic)

- Established : Jan 1, 1973.

- It has four subsidiary companies:

I. National Insurance Company Ltd, Kolkata.

II. The New India Assurance Co. Ltd, Mumbai

III. The Oriental Fire & General Insurance Co. Ltd, New Del.,

IV. United India Fire & General Insurance Co. Ltd, Chennai.

Stock Exchanges :-

-

Stock exchange or share market plays a dominant role in mobilizing resources for corporate sector. It is a market for dealing in shares, debentures and financial securities. In the stock exchange, shares and debentures are bought and sold for investment as well as for speculative purposes.

-

There are 24 stock exchanges in the country, oldest being the Bombay Stock Exchange (BSE).

Securities & Exchange Board of India (Sebi)

-

It was established in April, 1988, and awarded statutory status by an Act of Parliament in 1992.

-

It is the regulatory authority of stock exchanges and protects investors from fraudulent dealings.

-

The SEBI has now hiked the monetary penalties for various offences to either three times the unlawful gains made by a market player or a maximum of Rs. 25 crore

World Trade Organisation (Wto)

-

It was constituted on January 1, 1995 and took the place of GNIT (General

-

Agreement on Tariffs and Trade) as an effective formal organization. GATT was an informal organization which regulated world trade since 1948.

-

Its headquarter is at Geneva. Mr. Pascal Lamy is the present Director-General of WTO.

-

The present membership of WTO is 153.

-

The highest authority of policy making is WTO’s Ministerial Conference which is held after every two years.

| Conference | Year | Place |

| First | 1996 | Singapore |

| Second | 1998 | Geneva |

| Third | 1999 | Seattle (USA) |

| Fourth | 2001 | Doha (Qatar) |

| Firth | 2003 | Cancun (Mexico) |

| Sixth | 2005 | Hongkong |

- Function : To provide facilities for implementation, administration and operation of multilateral and bilateral agreements of the world trade.

Asian Development Bank (Adb)

- It was established in Dec. 1966 on the recommendations of ECAFE (Economic Commission for Asia and Far East).

- The aim of this bank is to accelerate economic and social development in Asia and Pacific region.

- The head office of the bank is located in Manila, Philippines.

- The ADB finances and gives technical assistance for development projects and programs; encourages public and private capital investment for development purposes and helps in coordinating development policies and plans of developing member-countries.

Census-2011 (Provisional Data)

India At A Glance

Area :

| Area of India : | 3,287,240 Sq km.* | |

| Largest State | Rajasthan | 342,239 Sq km |

| Smallest State Goa | 3,702 Sq km | |

| Largest Union Territory | Andaman & Nicobar Islands | 8,249 Sq km |

| Smallest Union Territory | Lakshadweep | 32 Sq km |

| Largest District | Kachchh (Gujarat) | 45,652 Sq km |

| Smallest District | Mahe ( Pondicherry ) | 9 Sq km |

* The area figure exclude 78,114 sq. km. under the illegal occupation of Pakistan, 5,180 sq. km. Illegally handed over by Pakistan to China and 37,555 sq.km. under the illegal occupation of China in Ladakh district.

| Administrative | Division |

| No. of States | 28 |

| No. of Union Territories | 7 |

| No. of Districts | 593 |

| No. of Sub-districts | 5,463 |

| No. of CD Blocks (as per map profile) | 6,374 |

| No. of Urban Agglomerations / Towns | 4,378 |

| No. of Urban Agglomerations | 384 |

| No. of Towns | 5,161 |

| No. of Inhabited Villages | 593,732 |

| (as per PCA TAS) | |

| No. of Uninhabited Villages | 44,856 |

Top Ten Population Countries - World Population and India

| Country |

Percent (%) of World Population |

| China | 19.4 |

| India | 17.5 |

| USA | 4.5 |

| Indonesia | 3.4 |

| Brazil | 2.8 |

| Pakistan | 2.7 |

| Bangladesh | 2.4 |

| Nigeria | 2.3 |

| Russia Federal | 2.0 |

| Japan | 1.9 |

| Others | 41.2 |

2011 Census of India

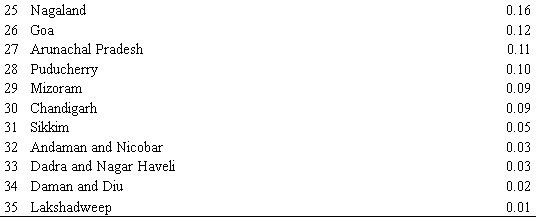

The 15th Indian National census was conducted in two phases, houselisting and population enumeration. Houselisting phase began on April 1, 2010 and involved collection of information about all buildings. Information for National Population Register was also collected in the first phase, which will be used to issue a 12-digit unique identification number to all registered Indians by Unique Identification Authority of India. The second population enumeration phase was conducted between 9 to 28 February 2011. Census has been conducted in India since 1872 and 2011 marks the first time biometric information was collected. According to the provisional reports released on March 31, 2011, the Indian population increased to 1.21 billion with a decadal growth of 17.64%. Adult literacy rate increased to 74.04% with a decadal growth of 9.21%.

Scope and process

Spread across 35 States and Union Territories, the Census covered 640 districts, 5767 tehsils, 7742 towns and more than 6 lac villages. 2.7 million officials visited households in 7,935 towns and 6,40,867 villages, classifying the population according to gender, religion, education and occupation. The cost of the was in the region of INR2,200 crore (US$490.6 million) – this comes to less than $ 0.5 per person, well below the estimated world average of $4.6 per person. The exercise, conducted every 10 years, faced big challenges, not least India’s vast area and diversity of cultures and opposition from the manpower is involved. Information on castes was included in the census following demands from several ruling coalition leaders including Lalu Prasad Yadav, Sharad Yadav and Mulayam Singh Yadav supported by opposition parties Bharatiya Janata Party, Akali Dal, Shiv Sena and Anna Dravida Munnetra Kazhagam.Information on caste was last collected during the British Raj in 1931. During the early census, people often exaggerated their caste status to garner social status and it is expected that people downgrade it now in the expectation of gaining government benefits.There is only one instance of a caste-count in post-independence India. It was conducted in Kerala in 1968 by the Communist government under E. M. S. Namboodiripad to assess the social and economic backwardness of various lower castes. The census was termed Socio-Economic Survey of 1968 and the results were published in the Gazetteer of Kerala, 1971. The census was conducted in two phases. The first houselisting phase began on April 1, 2010 and involved collection of data about all the buildings and census houses.Information for National population register was also collected in the first phase. The second population enumeration phase was conducted from 9 to 28 February 2011 all over the country.

Census Data

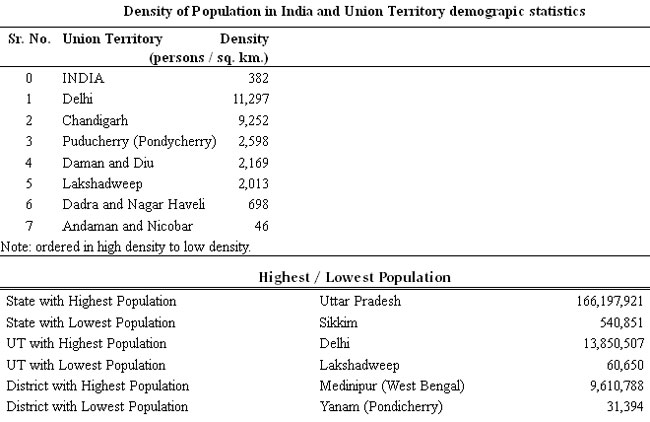

Census of India 2011 and Population of India 2011 at Glance

| Population | Statistics |

| Total Population | 1,21,01,93,422 (persons) |

| Males | 62,37,24,248 |

| Females | 58,64,69,174 |

| Ratio | 940 Females/1000 Males |

| Decadal Growth | 18,14,55,986(17.64%) |

| (2001-2011) | |

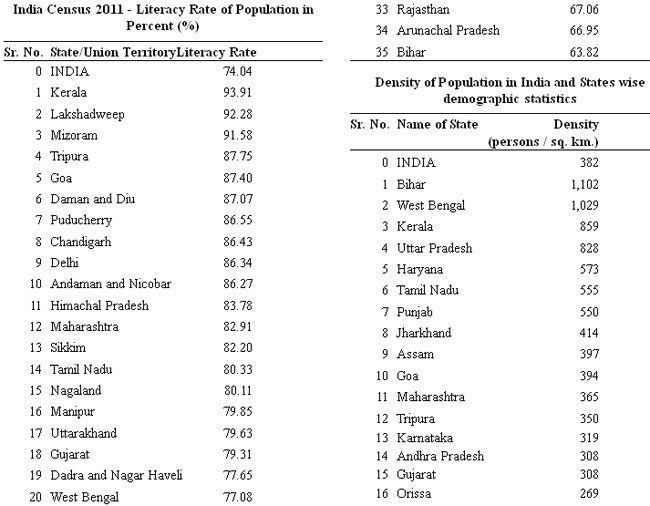

| Density of Population | 382 per sq. km. |

| Literacy(in percent) | Total; 74.04, Males: 82.14, Females: 65.46. |

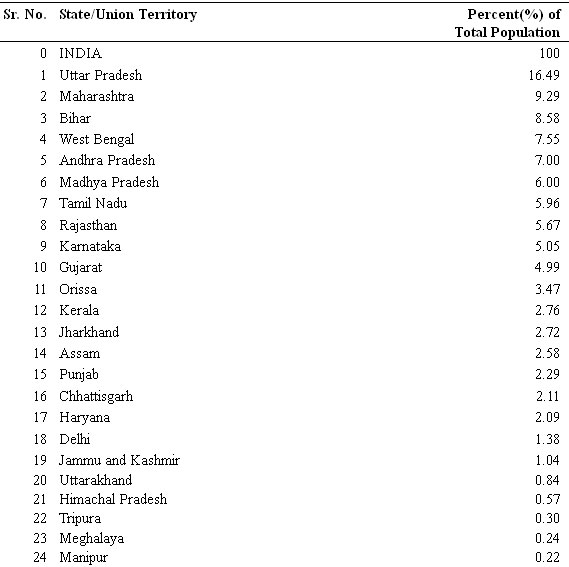

State wise Population and Percent(%) of Total Indian Population as per India Cencus 2011

Economic Terminology

-

Arbitration : A method for solving disputes, generally of an industrial nature, between the employer and his employees.

-

Annuity : A fixed amount paid once a year or at interval of a stipulated period.

-

Ante date : To give a date prior to that on which it is written, to any cheque, bill or any other document.

-

Appreciation of Money : It is a rise in the value of money caused by a fall in the general price fall.

-

Assets : Property of any kin

-

Balance of Trade (or Payment) : The difference between the visible exports and visible imports of two countries in trade with each other is called balance of payment. If the difference is positive the balance of payment (BOP) is called favourable and if negative it is called unfavourable.

-

Balance Sheet : It is a statement of accounts, generally of a business concern, prepared at the end of a year, showing debits and credits under broad heads, to find out the profit and loss position

-

Banker’s Cheque : A Cheque by one bank on another.

-

Bank Rate : It is the rate of interest charged by the Reserve Bank of India for lending money to commercial banks.

-

Black Money : It means unaccounted money, concealed income and undisclosed wealth. In order to evade taxes some people falsify their account and do not record all transactions in their books. The money which thus remains unaccounted for is called Black Money.

-

Barter : To trade by exchanging one commodity for another.

-

Bear : A speculator in the stock market who believes that prices will go down.

-

Bearer : This term on cheques and bills denotes that any person holding the same has the same right in respect of it, as the person who issued it.

-

Bond : A legal agreement to pay a certain sum of money (called principal) at some future date and carrying a fixed rate of interest.

-

Bonus : It is in addition to normal payment of divident to shareholders by a company, on an extra gratuity paid to workers by the employer.

-

Budget : An estimate of expected revenues and expenditure for a given period, usually a year, item by item.

-

Budget deficit : When the expenditure of the government exceeds the revenue, the balance between the two is the budget deficit.

-

Bulls : Speculators in the stock markets who buy goods, in some cases without money to pay with, anticipating that prices will go up.

-

Buyer’s Market : An area in which the supply of certain goods exceeds the demands so that purchasers can drive hand bargains.

-

Carat : Measure or weight of precious stones. 24 carat gold is the purest gold, thus 22 carat gold means a piece of gold in which 22 parts are pure gold and 2 parts of an alloy, usually copper.

-

Cartel : It is a combination of business, generally in the same trade formed with a view to controlling price and enjoying monopoly.

-

Caution Money : It is the money deposited as security for the fulfilment of a contract or obligation.

-

Call Money : Loan made for a very short period. It carries a low rate of interest.

-

Credit, Letter of : A letter from a bank or a firm authorising payment to a third person of a specific sum for which the sender assumes full responsibility.

-

Commercial Banks : Financial institutions that create credit accept deposits, give loans and perform other financial functions. They create credit by creating deposits on the basis of their cash reserve ratio.

-

Deflation : It is a state in monetary market when money in circulation has decreased and is characterised by low prices, unemployment, etc.

-

Depreciation : Reduction in the value of fixed assets due to wear and tear.

-

Depression : A phase of the business cycle in which economic activity is at a low ebb and there is mass scale unemployment and underemployment of sources. Prices, profits, consumption, etc are also at a low level.

-

Devaluation : Official reduction in the foreign value of domestic currency. It is done to encourage the country’s exports and discourage imports.

-

Direct Tax : Taxes that are directly borne by the person on whom it was initially fixed. e.g.: Personal income tax.

-

Divident : Earning of stock paid to share holders.

-

Dumping : Sale of a commodity at different prices in different markets, lower price being charged in a market where demand is relatively elastic.

-

Exchange Rate : The rate at which central banks will exchange one country’s currency for another.

-

Excise Duty : Tax imposed on the manufacture, sale and consumption of various commodities, such as taxes on textiles, cloth, liquor, etc.

-

Fiscal Policy : Government’s expenditure and Tax policy.

-

Foreign Exchange : Claims on a country by another, held in the form of currency of that country. Foreign exchange system enables one currency to be exchanged for another, thus facilitating trade between countries.

-

Gross Domestic Product (GDP): A measure of the total flow of goods and services produced by the economy over a specific time period, normally a year. It is obtained by valuing output of goods and services at market prices and then aggregating

-

Indirect Taxes : Taxes levied on goods purchased by the consumer for which the tax payer’s liabilities varies in proportion to the quantity of particular good: purchased or sold.

-

Inflation : A sustained and appreciable increase in the price level over a considerable period of time

-

Laissez-faire : The principle of non-intervention of government in economic affairs.

-

Mixed Economy : The economy in which there is a unique blend of public sector and private sector co-exist. The perfect example is India.

-

National Income : Total of all incomes earned or inputted to factors of productions, used in economic literature to represent the output or income of an economy in a simple fashion.

-

Per Capita Income : Total GNP of a country divided by the total population. It is often used as an economic indicator of the levels of living and development. However, it is a biased index because it takes no account of income distribution.

-

Patents : It is an exclusive right granted under the Patents Act to the inventor for a new invention.

-

Preference Shares : These are the shares entitled to a fixed divident before any distribution of profits can be made amongst the holders of ordinary shares or stock.

-

Public Sector : A term which is generally applied to state enterprises, i.e., those companies which are nationalised and run by the government.

-

Recession : It happens when there is excess of production over demand.

-

Statutory Liquidity Ratio (SLR) : It is the ratio of cash in hand, exclusive of cash balances maintained by banks to meet required CRR.

-

Tariff (ad valorem) : A fixed percentage tax on the value of an imported commodity, levied at the point of entry into the importing country.

-

Value Added Tax (VAT) :A tax levied on the values that are added to goods and services turned out by the producers during stages of production and distribution.

-

Zero Based Budgeting (ZBB) : The practice of justifying the utility in cost benefit terms of each government expenditure on projects. The ZBB Technique involves a critical review of every scheme before a budgetary provision is made in its favour. If ZBB is properly implemented it could help to reverse the trend of large deficits on the revenue account of the Union Government.